It sounds simple: You take the plunge and buy a reasonably priced real estate with small “faults” that are easy to fix and without much effort.

To be successful in Real Estate Investment through renovation you make sure that the building is in a not-too-bad condition. It´s vital to make your research! The least you need to fix, the more you can save. Then it’s time to plan, what needs to be done to create a good layout, make it a charming, attractive property that you can rent and make money from?

You should pay particular attention to those things that attract potential tenants: Maybe a modern open plan kitchen, a gorgeous bathroom and a nice garden…

So far you have to invest money, otherwise you cannot earn anything.

After you finished the renovation of your real estate, you now have two options, depending on your financial needs.

If your goal is to raise a sum of money all at once, then look for a buyer for the house.

Coming up with the asking price is simple: your invested money and the targeted profit make up the purchase price at which you resell the property.

If you rather like to have a regular income from your real estate, then rent it out. Like this you have a guaranteed steady income over a longer period.

If you are experiencing financial difficulties, you always have your real estate and you can sell it anytime to make a larger amount of money.

The only question is: Is real estate investment through renovation not too risky?

The starting point is simple: the cheaper the renovation can be made, the higher the earning potential. Of course, handy people have an advantage here. If you can do a lot yourself, the costs are reduced.

Be balanced. You should not overestimate yourself and certainly not underestimate. With time and commitment, you can work out much yourself. In addition, the Internet is full of information and DIY tutorials.

Of course, you must invest time, but working on a house is fun and, above all, it’s a paid hobby.

Conclusion for Real Estate Investment through renovation

You must be aware that it will take a lot of patience and commitment.

Maybe you don´t find the right tenant straight away. But sooner or later that will be the case. Every entrepreneur, and one such is you if you want to make money, must take some risk. The chance that it will pay is high.

In summary, it can be said that investing money is never easy. However, investing in slightly older properties is a good way to invest your money.

Look around, if you have found the ideal house, go for it!

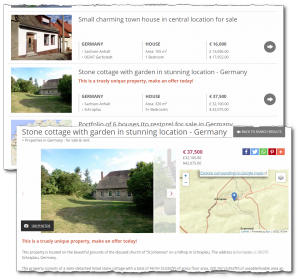

Here you can find some renovation projects from our site.

It sounds simple: You take the plunge and buy a reasonably priced real estate with small “faults” that are easy to fix and without much effort.

To be successful in Real Estate Investment through renovation you make sure that the building is in a not-too-bad condition. It´s vital to make your research! The least you need to fix, the more you can save. Then it’s time to plan, what needs to be done to create a good layout, make it a charming, attractive property that you can rent and make money from?

You should pay particular attention to those things that attract potential tenants: Maybe a modern open plan kitchen, a gorgeous bathroom and a nice garden…

So far you have to invest money, otherwise you cannot earn anything.

After you finished the renovation of your real estate, you now have two options, depending on your financial needs.

If your goal is to raise a sum of money all at once, then look for a buyer for the house.

Coming up with the asking price is simple: your invested money and the targeted profit make up the purchase price at which you resell the property.

If you rather like to have a regular income from your real estate, then rent it out. Like this you have a guaranteed steady income over a longer period.

If you are experiencing financial dificulties, you always have your real estate and you can sell it anytime to make a larger amount of money.

The only question is: Is real estate investment through renovation not too risky?

The starting point is simple: the cheaper the renovation can be made, the higher the earning potential. Of course, handy people have an advantage here. If you can do a lot yourself, the costs are reduced.

Be balanced. You should not overestimate yourself and certainly not underestimate. With time and commitment, you can work out much yourself. In addition, the Internet is full of information and DIY tutorials.

Of course, you must invest time, but working on a house is fun and, above all, it’s a paid hobby.

Conclusion Real Estate Investment through renovation

You must be aware that it will take a lot of patience and commitment.

Maybe you don´t find the right tenant straight away. But sooner or later that will be the case. Every entrepreneur, and one such is you if you want to make money, must take some risk. The chance that it will pay is high.

In summary, it can be said that investing money is never easy. However, investing in slightly older properties is a good way to invest your money.

Look around, if you have found the ideal house, go for it!

Find some renovation projects on our site.